One of the original purposes of Load Network was to add robust EVM financialization to the permaweb. Arweave is the world’s harddrive, and the EVM’s battle-tested token standards and DeFi infrastructure mean new financial use cases can emerge on top.

That’s why we’re so pleased to see Nau Finance come into the ecosystem. Nau is founded and funded under Vela Ventures who are also responsible for the Vento bridge on AO and the multichain Beacon wallet.

In this post we’ll explore why Nau is so exciting, the use cases it unlocks, and why it’s built on Load Network.

What is Nau?

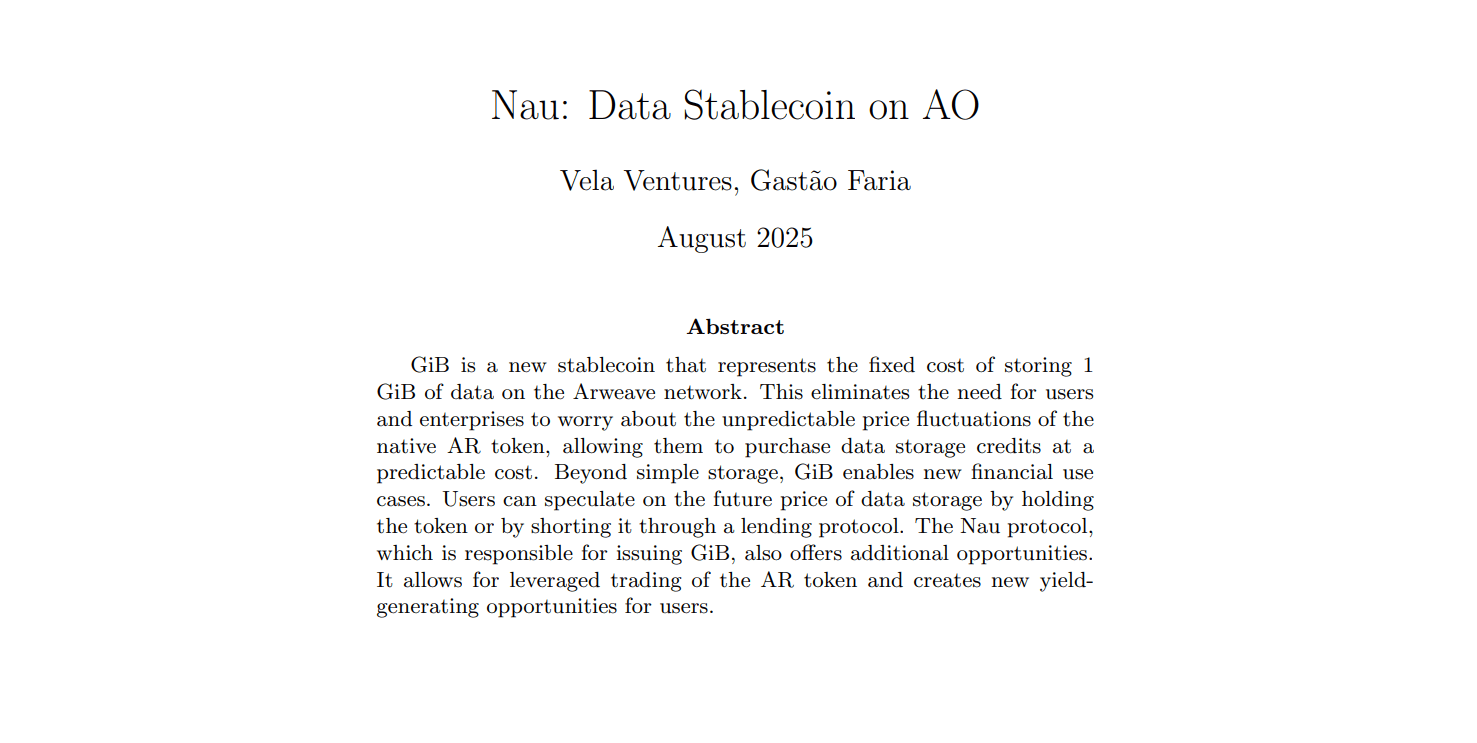

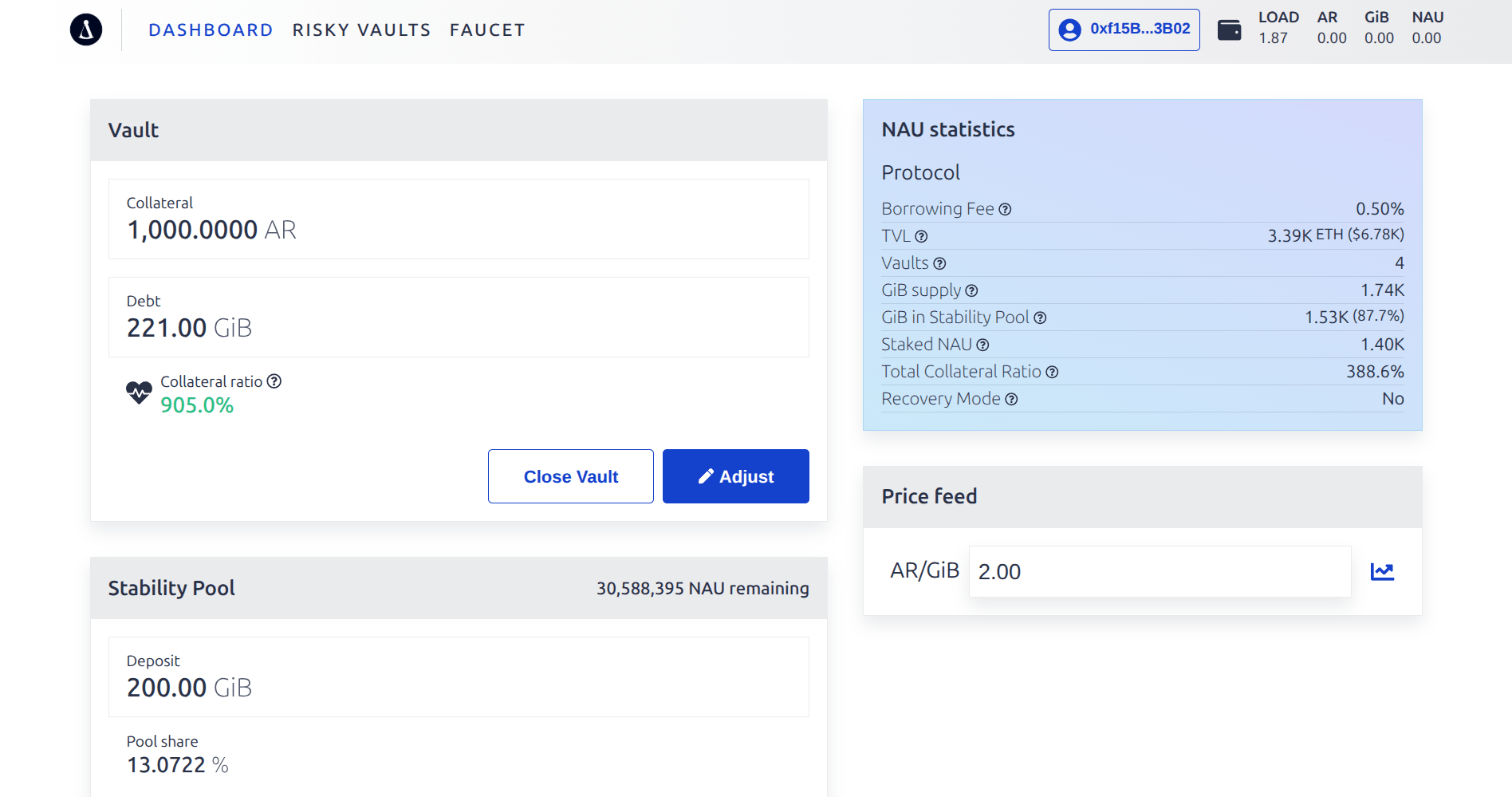

Nau Finance is the first borrowing protocol purpose-built for the permanent storage economy. It introduces the GiB token - a stablecoin pegged to the cost of 1 GiB of storage on Arweave. Users can deposit AR as collateral to mint GiB. Rather than tracking fiat currencies, GiB represents actual storage capacity. This means predictable costs for users and developers, unlocking capital efficiency for AR holders.

Why a data stablecoin?

Typical stablecoins peg to fiat currencies, but GiB is solving a different challenge: AR holders face a binary choice between holding for long-term value or spending for immediate storage needs. Creators struggle to budget when AR fluctuates, enterprises might not commit to SLAs with volatile pricing, and builders need predictable costs to scale applications.

GiB solves this by decoupling storage purchasing power from AR price volatility. 50 GiB tokens always equals 50 GiB of permanent storage, whether AR is up or down in dollar terms.

The HyperBEAM oracle

For GiB to work, the Nau protocol needs reliable real-time data about storage costs. Until now, there has been no trustless feed for Arweave’s price-per-byte, but that’s where a custom HyperBEAM-powered oracle comes in.

Built on AO (Arweave’s hyper-parallel computer), the HyperBEAM oracle provides tamper-resistant price feeds for AR-per-byte-of-storage to Load Network, following the micro-modular architecture of HyperBEAM NIFs. This cross-chain oracle architecture means a robust data bridge between Arweave and the EVM, AO-native compute, and room to grow into a full HyperBEAM-powered oracle network. When GiB trades off peg, the protocol uses oracle data to burn or mint tokens, maintaining stability algorithmically.

Try Nau on Testnet

Ready to experience data-backed DeFi? Here’s how to get started:

- Get LOAD tokens from the Load faucet

- Get testnet AR from the Nau faucet

- Open a vault at app.naufi.xyz

- Deposit testnet AR as collateral

- Borrow GiB tokens at a predictable rate

Explore vaults, stability pools, and see how data-backed stability works.

The NAU token and fair launch

While GiB provides stability for storage users, the NAU token captures the value generated by protocol activity. NAU holders earn revenue from borrowing fees and liquidations, creating incentives for participants who help maintain system health.

- Stake NAU to earn a share of protocol fees (paid in GiB and AR)

- Supply to the Stability Pool to earn NAU rewards while providing liquidation backstop

- Participate in the fair launch to acquire NAU on equal terms with the community

NAU follows a fair launch model with no private sales or early investor advantages. 45% goes to community rewards, 20% to fair launch participants, and 24% to the team with a 5-year monthly vest (0.4% of supply per month) and 6 month cliff. The token uses a yearly halving schedule, rewarding early participants while ensuring long-term sustainability.

With the fair launch underway, we’re excited to see funding flowing into dApps in the Load Ecosystem, ensuring growth and sustainability.

Further reading

- Nau homepage

- Nau whitepaper (PDF)