Data is at its most useful when combined with compute and money. That’s why Load Network has always been more than just a storage and data availability layer—we’re building an integrated platform that combines DA, storage, and smart contract functionality in a single layer. And today we’re unveiling Load’s DeFi primitives:

- The DEX: tapestry.fi

- The bridge: bridge.load.network

- The stablecoin: USDL

Load’s super high bandwidth — 3.3x Monad, 16.6x Base — is ideal for financial use cases where speed and UX matter. And with an eightfold improvement to these metrics on the horizon with Load Fibernet, the onchain data center is a high-performance DeFi and dApp layer on top of its existing use cases as infra-for-infra.

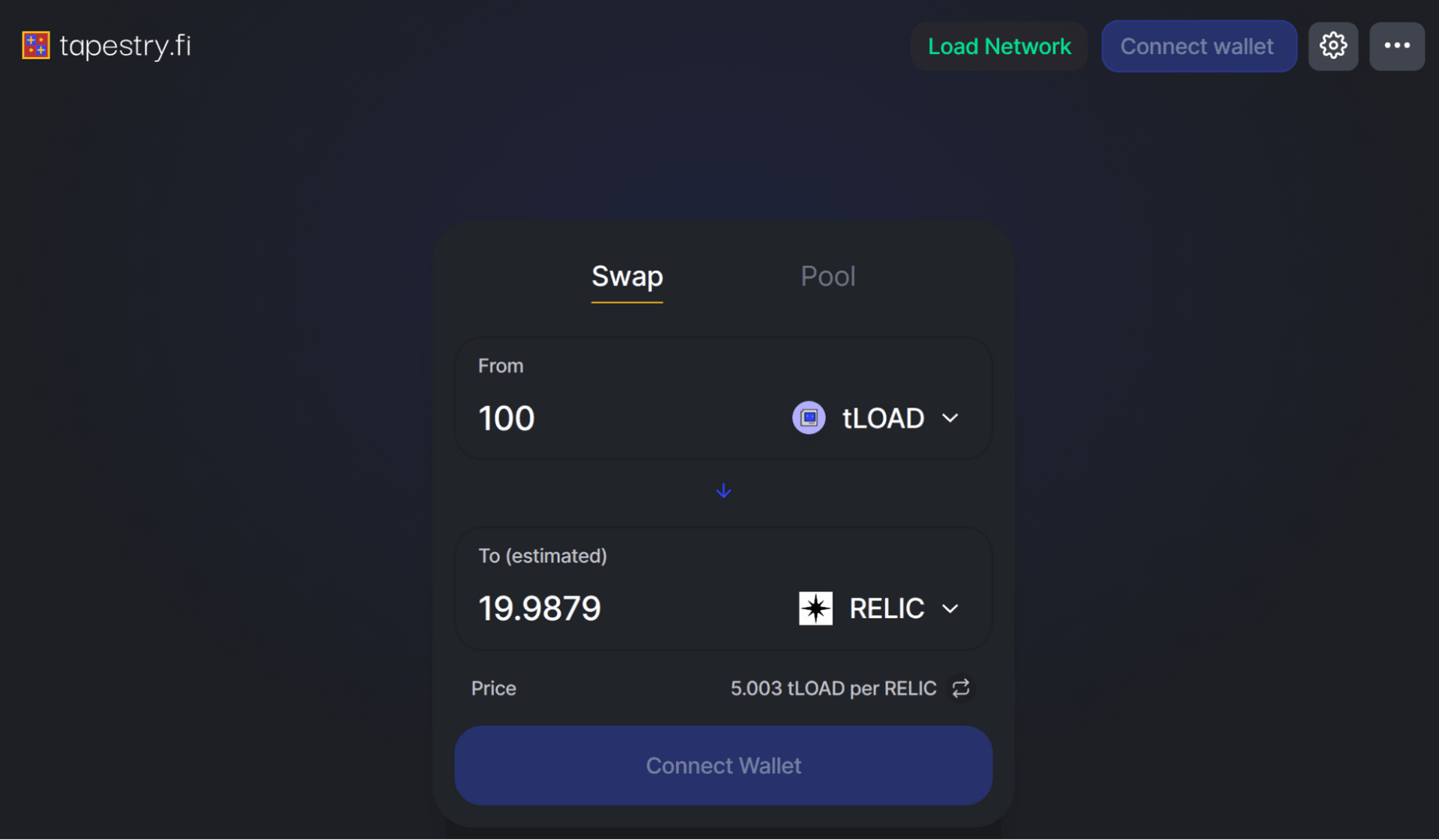

Tapestry, Load’s Uniswap V3

Tapestry.fi is Load Network’s Uniswap V3 clone – built on top of Load’s Network 500 mgas/s performance, Tapestry users get a high-performance trading experience with 1 second finality and the robustness of a proven codebase.

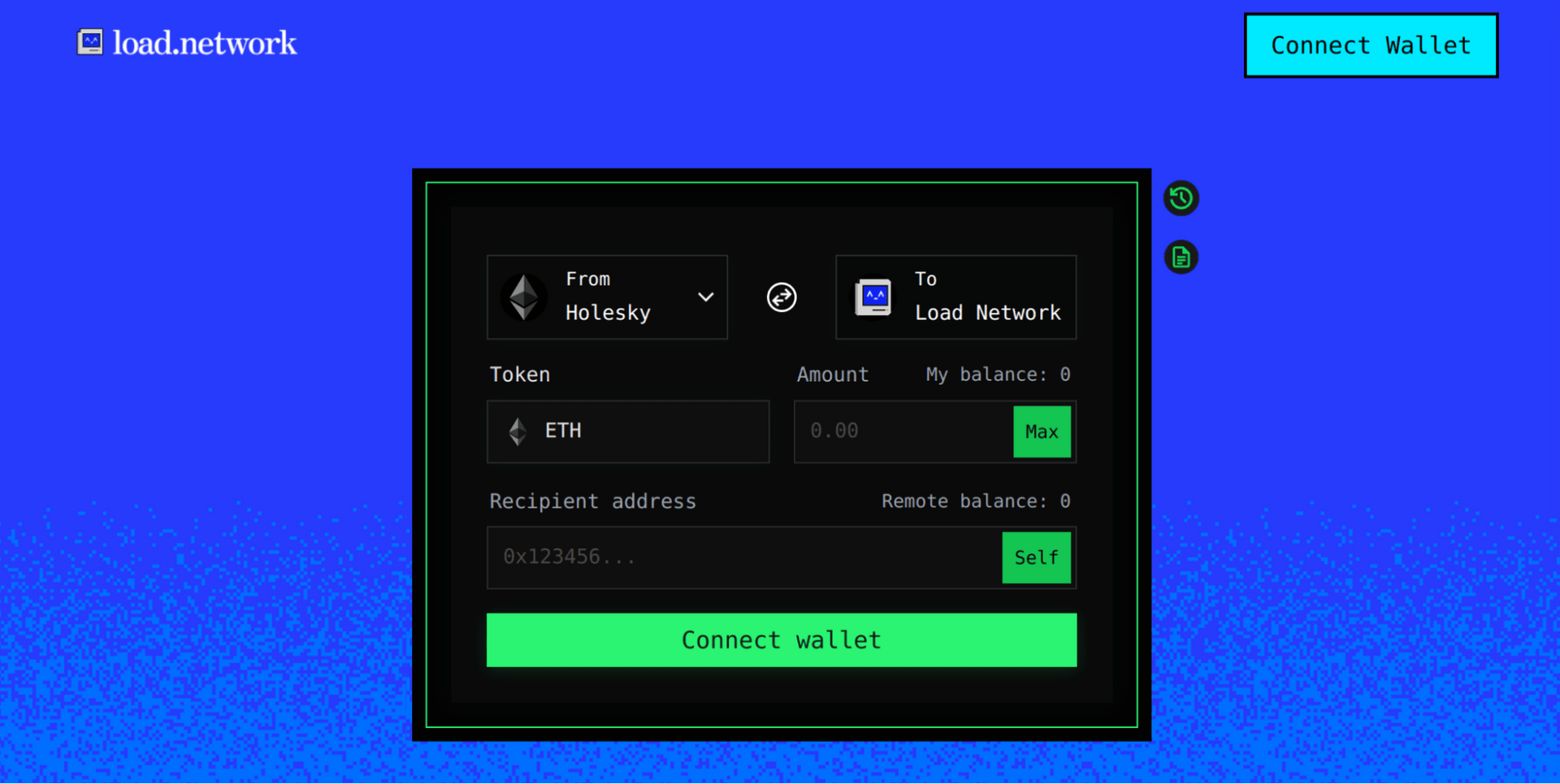

Load Network Bridge

Another core component of any EVM network with a DeFi layer is a crosschain bridge – and today we are unveiling bridge.load.network, bridge assets bidirectionally between Load’s Alphanet V4 and Ethereum Holesky, powered by Hyperlane.

Today the bridge supports Holesky ETH, but we’re soon adding support for a certain stablecoin…

Introducing USDL: Astro’s Full-Stack Stablecoin Infrastructure for Load Network

We’re partnering with Astro Labs to deploy USDL — using Astro’s full-stack stablecoin infrastructure with built-in ecosystem monetization for Load Network.

While we continue advancing our data infrastructure, Astro will help develop, deploy, and maintain this critical financial layer.

What sets USDL apart from conventional stablecoins is its dual focus on stability and ecosystem value capture. Backed by USDC, USDT and DAI with more asset supported later. USDL introduces the first significant TVL opportunity for Load Network, ensuring 1 USDL can always be minted or redeemed for 1 USD worth of value.

The financial layer driving our data economy should reinforce our mission, not extract value from it. By implementing USDL, we’re creating predictable data storage costs for L1s, L2s, and data-intensive dApps while generating new revenue streams from storage and retrieval activities. In short:

USDL will fund Load ecosystem growth

Yield from holding USDL can be diverted to incentivise any pool, protocol, or validator set on the network, creating a growth flywheel for anything that contributes to the growth of Load’s utility.

Stay tuned for more news about USDL in the near future, follow along @AstroUSD & @useload